Property Insurance

Your home is insured, but not only!

- Buildings and structures up to 20 m2 in size are also insured for up to 15,000 euros alongside the building.

- Built-in furniture and integrated kitchen appliances are also insured.

- All fire safety installations that service the building or the apartment are insured.

- Solar panels and other structures located on the plot can also be insured as structures.

- Portable property, e.g. phone or laptop, photography equipment, etc., is insured.

24/7 property assistance package

How much are your gadgets worth?

Liability insurance protects you if your or your family members have caused damage to others.

Additional information and insurance terms

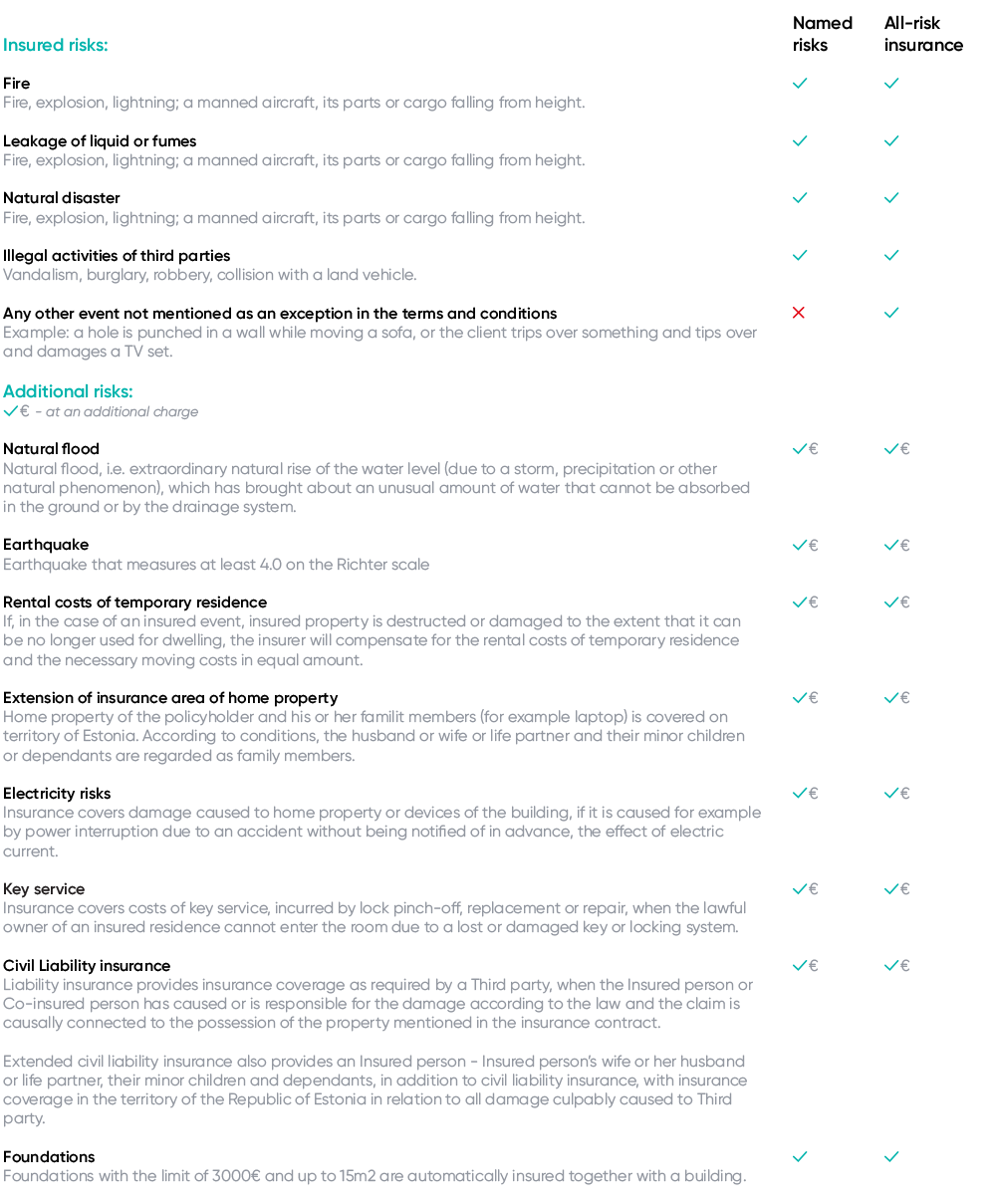

1. When insuring, choose All-risk Insurance that provides the widest insurance cover.

2. Choose a sufficient sum to insure your home property with according to its value.

3. Choose additional cover for portable property: home property insurance cover outside the place of residence.

4. When living on higher floors, choose a bigger sum of insured liability insurance to cover all claims for the apartments below in case of accident.

5. Read the insurance terms and conditions and ask customer service if necessary.

You can insure:

- residential and outbuildings;

- apartments and apartment ownerships;

- domestic property, i.e. movable property located at the place of insurance.

In the case of a building or apartment, the insured object is its structural elements and other important parts, e.g. interior decoration, technical systems, built-in furniture, etc. In the case of household property, the insured object is furniture, household appliances, clothes, leisure equipment, etc.

The place of insurance is a building located at the address specified in the insurance contract.

Home property (movable property located at the place of insurance) can also be insured outside the place of insurance within Estonia or another territory.

Insurance service information documents

Home insurance terms and conditions

All risks insurance

Terms and conditions No. EE01NA-1

effective as of 16.06.2021

Terms and conditions No. EE1E-2

effective as of 20.12.2016 till 15.06.2021

Terms and conditions No. EE1E-1

effective as of 17.06.2014 till 19.12.2016

Named perils insurance

Terms and conditions No. EE1F-2

effective as of 20.12.2016 till 15.06.2021

Terms and conditions No. EE1F-1

effective as of 17.06.2014 till 19.12.2016

Terms and conditions No. 3D-1

effective as of 14.12.2010 till 16.06.2014 (in estonian)

General Insurance Terms and Conditions

Terms and Conditions No. GC 2019.0

effective as of 01.07.2019

Terms and Conditions No. GC-2012

effective as of 01.12.2011 till 30.06.2019

BTA customer reviews

Jelena

'' I give high marks for professionalism and friendly prices."

Jüri

"The process is simple, and a reminder is sent when it’s time to renew the policy."

Kairi

"Fast, customer-friendly communication and good problem-solving ability, thank you!"

Mihkel

"Personalized service and finding a solution that meets the customer’s needs."

Maria

"It's convenient to keep track of your insurances."

Get in touch

Fill in the application and we will contact you on the desired topic.

Fields with an asterisk are required.